What Is the Morning Star candlestick pattern?

Structure of the Morning Star candlestick pattern

Difference between a Morning Star and an Evening Star

How to read Morning Star candlestick charts

How to trade a Morning Star pattern

Pros and cons of the Morning Star candlestick

How reliable the Morning Star candlestick is

The Morning Star and Evening Star patterns are among the so-called Japanese candlestick patterns that have been used by Forex traders for decades. These patterns are vital tools for getting insights into market reversals. Thus, they can aid you in making informed decisions.

What is the Morning Star candlestick pattern?

The Morning Star candlestick is a bullish reversal pattern widely used in technical analysis. It consists of three candles and often signals a potential upward trend in the market. It heralds higher prices in the market, just as the morning star (the planet Mercury) heralds the rising Sun.

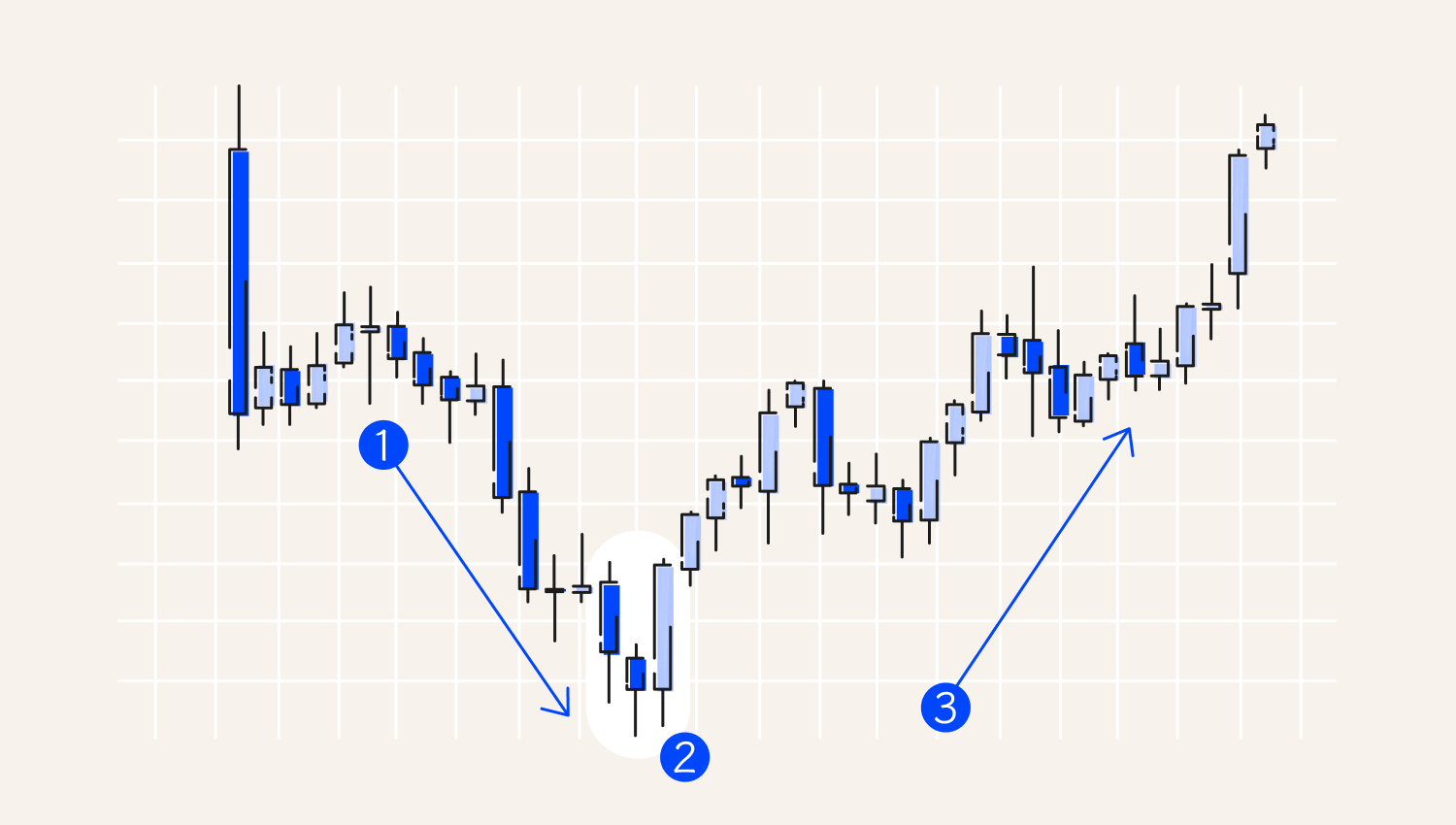

The pattern starts with a long-bodied red candle marking the continuation of the downtrend. This bearish candle is followed by a shorter middle candle, indicating a pause in the downward movement. Finally, a significant green candle emerges, ultimately closing above the midpoint of the first candle's body. The below example showcases the importance of this pattern as a reversal pattern:

1. Bearish market

2. Bullish market

3. Morning Star pattern

Structure of the Morning Star candlestick pattern

Any Forex trader can recognise the Morning Star on a Japanese candlestick chart if they know its structure. This candle stick pattern often appears at the end of a bearish trend. It consists of three candles at the bottom of a downtrend.

- A long bearish candle.

- A short candle (Small Candle).

- A long bullish candle.

1. Long bearish candle

2. Short candle

3. Long bullish candle

The primary condition for forming the pattern is that the second (small) candle must have the most similar tails on both sides. The size of the candle does not matter.

Difference between a Morning Star and an Evening Star

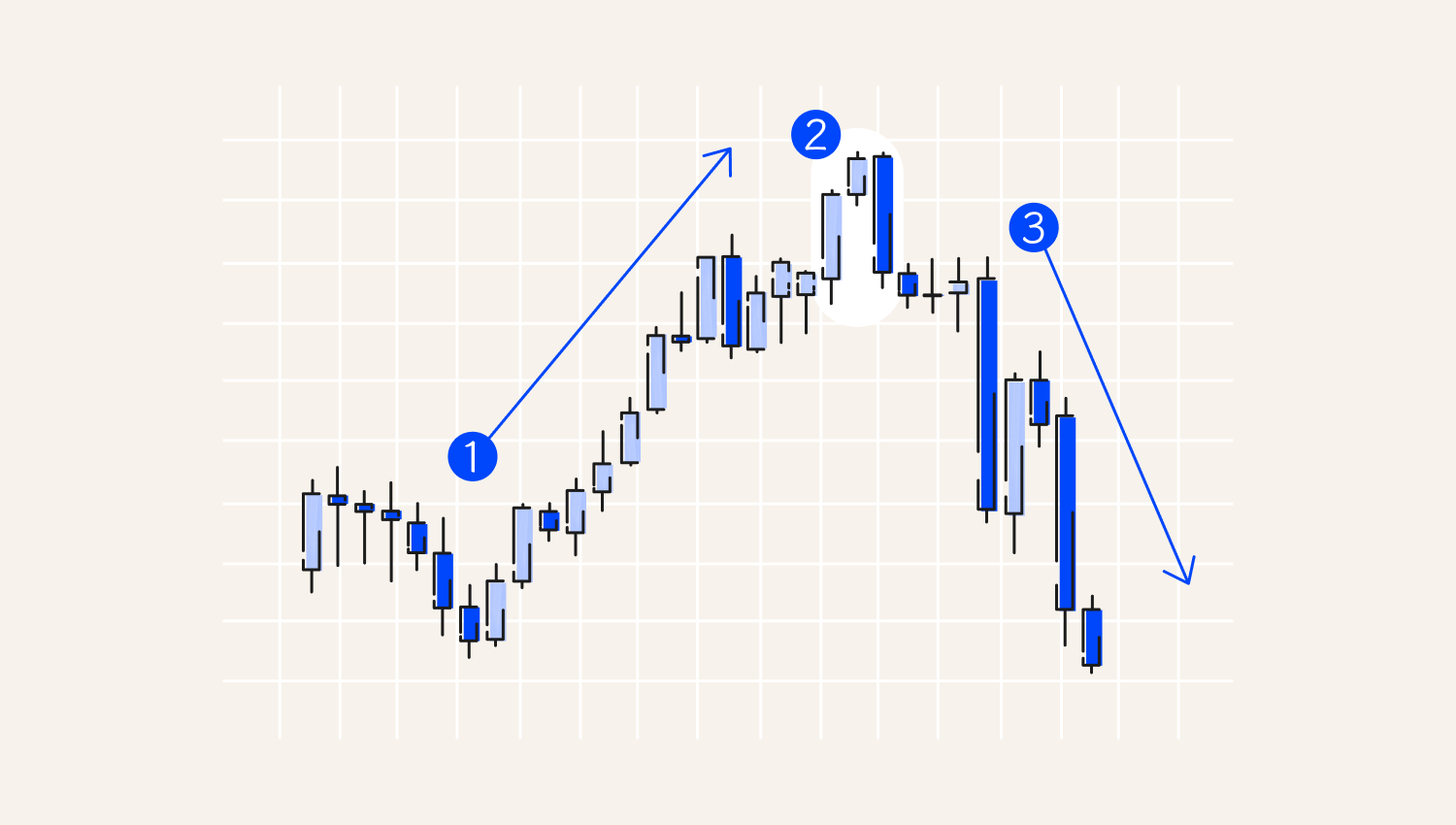

The Evening Star pattern forms at the top of a rising trend. It signals the possible beginning of a downtrend, just as the evening star (the planet Venus) appears before darkness falls. Since the Evening Star is a reversal pattern, traders pay attention to it if it occurs towards the end of an uptrend.

1. Bullish market in play

2. Evening Star pattern

3. Bearish market in play

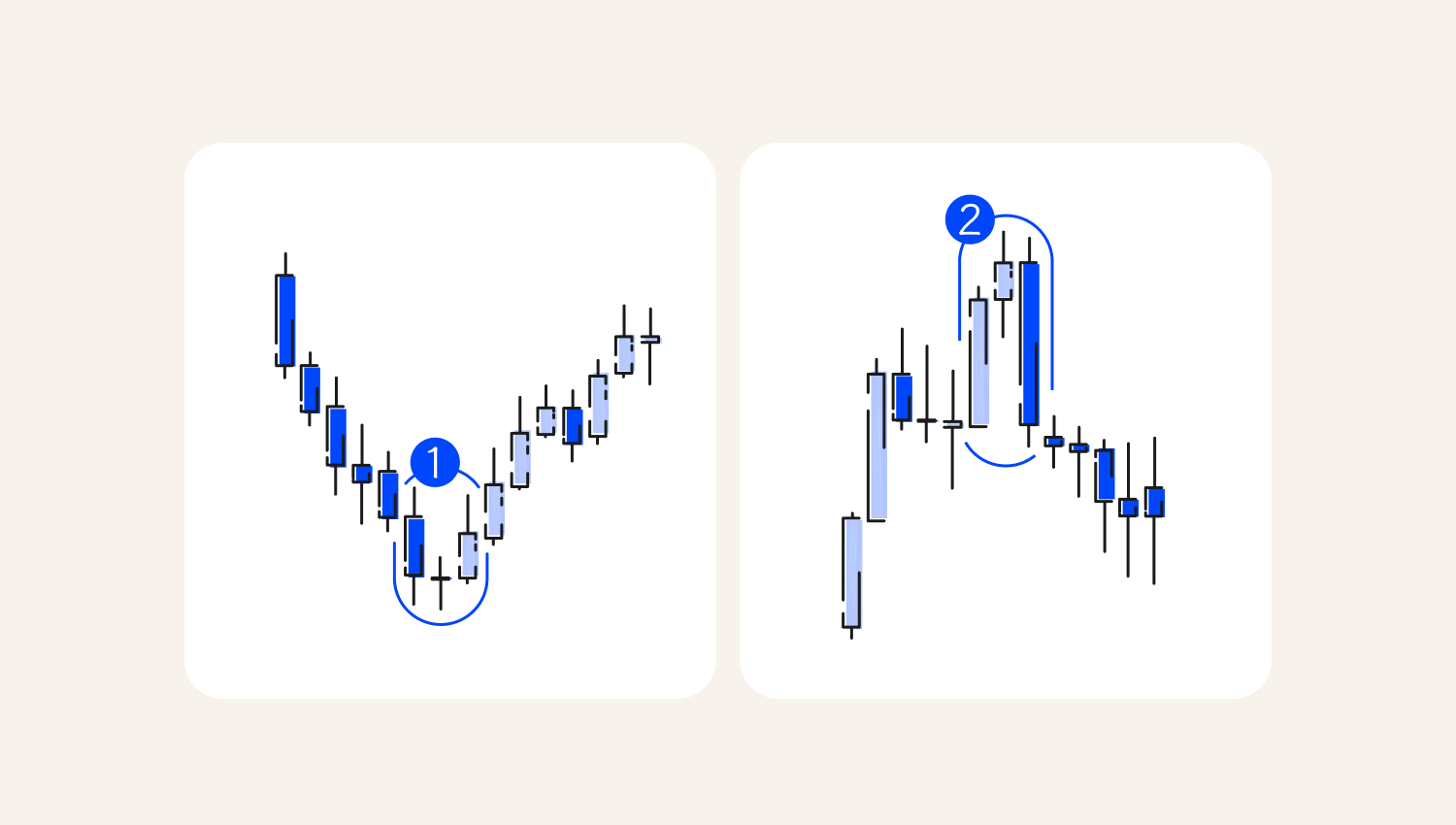

1. Morning star

2. Evening star

We've compiled the main differences between the two patterns into the following table.

|

Morning Star |

Evening Star |

| Appears at the bottom of a downtrend. | Appears at the top of an uptrend. |

| Consists of three candles: a long bearish one, a small neutral one, a long bullish one. | Consists of three candles: a long bullish one, a small neutral one, a long bearish one. |

| Means that more traders with a bullish mood are coming into the market. | Means that more traders with a bearish mood are coming into the market. |

| Indicates the possibility of an upcoming uptrend. | Indicates the possibility of an upcoming downtrend. |

How to read the Morning Star candlestick pattern

To recognise the pattern correctly, you need to understand the principle by which these candlesticks are formed.

To begin with, look for a bearish trend in the market.

- The market accelerates downward, and then a Morning Star forms. It starts with a big bearish candle with or without a spike.

- Next, a small candle is formed that indicates the market uncertainty about the continuation of the move. It can be bearish or bullish; a Doji is preferable.

- As a rule, the third candle of the pattern is the complete opposite of the first. It has a good-sized bullish body with a short spike or no spike at all. This part of the Morning Star indicates a potential reversal and a good opportunity for opening long positions. This reversal resembles the letter U but is more angular.

How to trade the Morning Star pattern

When looking to trade the Morning Star pattern, it's crucial to first identify a downtrend in the market. This downtrend is characterized by the market forming a bearish candle, followed by a small candle, which can be a Doji to signify market uncertainty. The third candle is typically bullish, signalling a potential trend reversal.

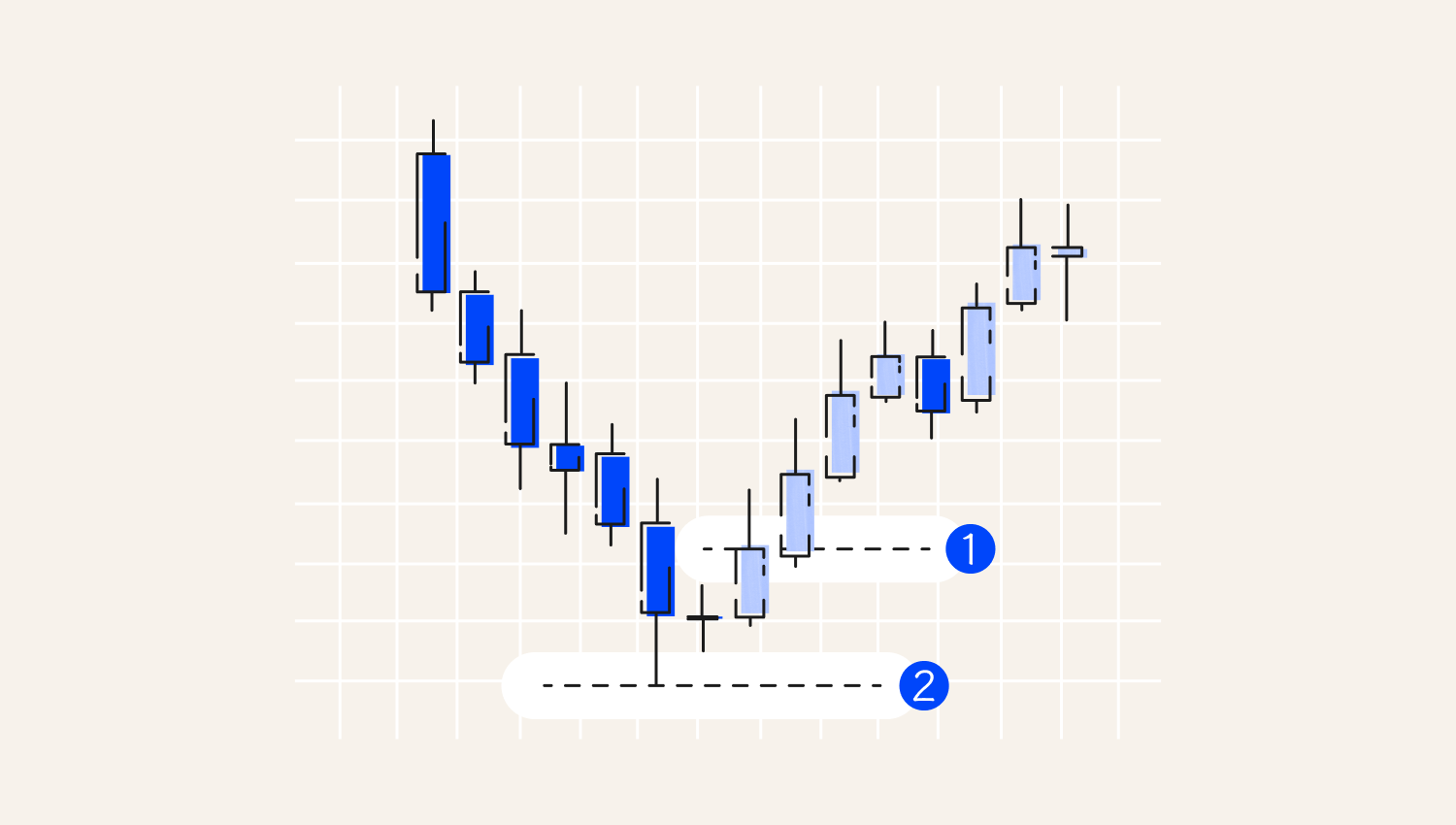

If the signal is confirmed, you should proceed as follows.

- Open a Buy trade after the closing of the third candle.

- Set your stop loss and take profit. The stop loss is placed below the Morning Star candlestick pattern. Profit targets can be set using predicted resistance levels, previous swing highs, or a risk/profit ratio of 1:2 or 1:3.

- If the trade moves half the number of pips, you are targeting to move your stop loss to break even and let the trade run risk-free till it hits your take profit.

1. Entry

2. Stop Loss

Pros and cons of the Morning Star candlestick

The Morning Star has many advantages.

- It can be found in almost all financial markets and timeframes.

- Identifying a Morning Star on a price chart is relatively simple.

- The Morning Star pattern gives traders more discounted entries for a bullish trend.

Like other candlestick patterns, the Morning Star has some rather significant disadvantages.

- There is no guaranteed movement. Even if you follow all the rules, there is a possibility of your stop loss being hit.

- Trading on a daily or weekly chart takes a lot of patience, discipline, and effort.

- In volatile market conditions, there is a high probability of being stopped at breakeven.

How reliable the Morning Star candlestick is

The Morning Star is a powerful candlestick pattern that most traders use in their daily trading strategies. However, in financial trading, no pattern can guarantee 100% profit.

Nevertheless, this article explains how one can use a Morning Star pattern to execute and manage a trade. As a result, traders can easily understand what is happening in the market. They can predict what the market presents and how they can take and manage a trade if an opportunity is issued.

In addition, its reliability depends on how the candles are formed. If the third candle eliminates the price action of the first and the second candles, reinforcing the price action, we can consider the buying opportunity strong.

At the same time, the Morning Star Pattern has a lower probability of working from a random location because the current trend cannot be said to have weakened. Thus, the success rate depends on the price trend, levels, candlestick formation, and market sentiment. Traders should consider other factors, not only the candlestick pattern, to increase the chances of success.

Even if you have the maximum probability of trading, there is a possibility of failure in using this pattern. Therefore, follow a risk management system and always use a stop-loss order in every trade.

Final thoughts

- The Morning Star candlestick pattern indicates the beginning of an uptrend.

- This candle stick pattern appears at the bottom of a downtrend or at a support level. The pattern consists of three candlesticks: two large candlesticks at the edges and a small candlestick at the centre.

- The Morning Star is a powerful candlestick pattern; however, it cannot guarantee a 100% profit.